This morning I read a good article in The New Republic about the Silicon Valley jobs market and the exercise of power in the labour market. It describes documents showing that the tech giants in 2005 colluded to keep wage rates down. This was news to me and seems pretty scandalous.

The article goes on to discuss in general why labour markets are not like goods markets, although most economics courses, and many grown-up economists, often speak as if they are. The fact that searching for a job is costly gives all employers a bit (or a lot) of monopsony power (or buyer power). And the prevalence of monopsony power needs to be taken into account in analysing the effect of an increase in the minimum wage: it will slightly decrease the employers’ power and reduce both job turnover and vacancies in low-wage jobs. There is some evidence to support this. The article also cites Alan Manning’s excellent book on this subject, [amazon_link id=”0691123284″ target=”_blank” ]Monopsony in Motion[/amazon_link].

[amazon_image id=”0691123284″ link=”true” target=”_blank” size=”medium” ]Monopsony in Motion: Imperfect Competition in Labor Markets[/amazon_image]

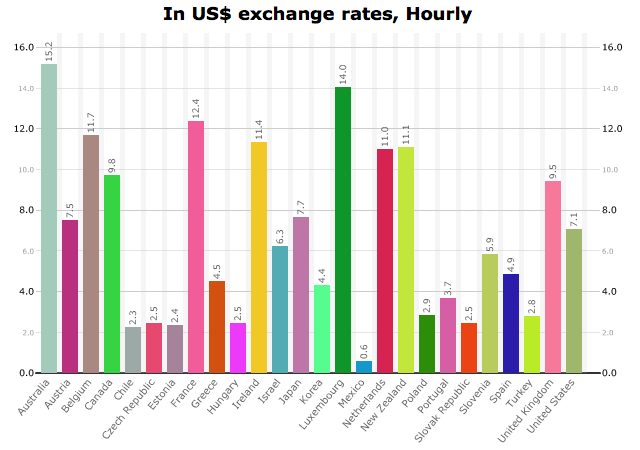

The US and UK minimum wages are middling by OECD standards (this chart from the OECD database deflates the statutory minimum by the national CPI and uses PPP for private consumption exchange rates to convert to US dollars). There is no obvious correlation with unemployment rates at this headline level.

OECD real hourly minimum wages

Labour market economics is one of the areas of the subject where economics most needs input from the other social sciences. Jobs and pay can’t really be understood without thinking about factors such as institutions, power, psychology and social norms. Never forget this when next reading about the way technology means inequality is inevitable.