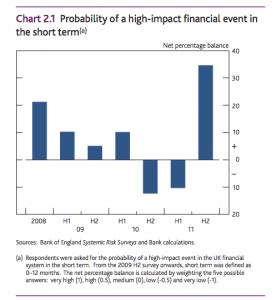

If you want to send shivers down your spine this weekend, you could try the ghost stories of [amazon_link id=”1840225513″ target=”_blank” ]M.R.James[/amazon_link] – or you could instead opt for the Bank of England’s Financial Stability Report, published yesterday. Consider for example the fact that the probability of a ‘high-impact event’ (i.e. a not-good development such as a bank collapsing….) in the UK financial sector is substantially higher now than in the Autumn of 2008.

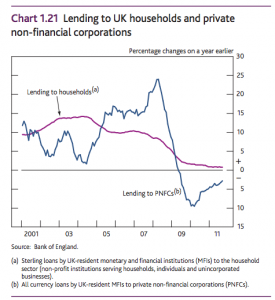

Or that banks’ lending to the private sector, households and businesses, has not increased at all and is in fact negative – that means we are paying money back to the banks.

Or that banks’ lending to the private sector, households and businesses, has not increased at all and is in fact negative – that means we are paying money back to the banks.

As Andy Haldane in his recent Wincott Lecture (pdf) presented estimates of the subsidy (via cheap funding from the Bank of England) to the UK banks as at least $58bn (approx £37bn), and perhaps much more, the subsidy plus repayments dwarf banks’ total profits – but do mean they’ve been able to pay bonuses and dividends. No wonder Governor Mervyn King upped the stakes by publicly demanding that they desist from doing so this year.

As Andy Haldane in his recent Wincott Lecture (pdf) presented estimates of the subsidy (via cheap funding from the Bank of England) to the UK banks as at least $58bn (approx £37bn), and perhaps much more, the subsidy plus repayments dwarf banks’ total profits – but do mean they’ve been able to pay bonuses and dividends. No wonder Governor Mervyn King upped the stakes by publicly demanding that they desist from doing so this year.

Odds on the banks paying any attention to this demand?