The Financial Times has a lot for Amazon-watchers today. Part 1 of a series on its business, and a separate story about ‘robo-pricing’ by retailers on the Amazon platform. Increasingly, retailers are using algorithms similar to those used by high-frequency traders in the financial markets to adjust their prices dynamically – say, to stay $1 below a close competitor, or to wage a high-speed price war. According to the report:

“Last year, out-of-control algorithms inflated the price of [amazon_link id=”0632030488″ target=”_blank” ]The Making of a Fly[/amazon_link], a genetics book, to more than $23m, according to Michael Eisen, a biologist who blogged about it.”

[amazon_image id=”0632030488″ link=”true” target=”_blank” size=”medium” ]The Making of a Fly: The Genetics of Animal Design[/amazon_image]

There are evidently firms specialising in the development of online pricing algorithms – the story name-checks Feedvisor but no doubt there are others. (Imagine explaining to your mum what your job is if you work for a company which is “the leading fully automated repricing solution for e-commerce marketplaces.”)

Eisen’s blog post is interesting. He watched the pricing arms race over a number of days, and inferred that one of the sellers did not in fact have a copy of a book. This means that in effect, it was an options trader, and pricing accordingly. Not so much a bookseller as a book arbitrageur.

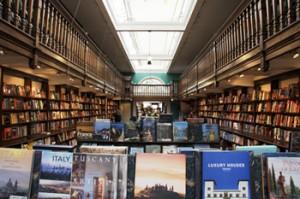

High-frequency trading in financial markets has some alarming results (I talked about these in my Tanner Lectures), creating a fundamental indeterminacy in prices and turning the markets from markets into something more like an online game. What are the implications of high-frequency bookselling? Maybe Yanis Varoufakis at Valve will have an answer. Meanwhile, although none of us can touch anything tangible in the financial markets any more, we can still pop out to a favourite bookstore and breathe in the scent of paper and ink, and coffee.

Daunts in Marylebone High Street