Paul Tucker’s book Unelected Power: The Quest for Legitimacy in Central Banking and the Regulatory State is a significant contribution to the literature about the trade-off between participatory democratic influence over policy decisions and the technical complexity of much policy and regulatory activity. The focus is on central banking, not surprisingly given the author’s long experience at the Bank of England. However, the book also dips into competition policy. This is my territory, having spent 8 years on the Competition Commission. I’m not entirely convinced by the argument here.

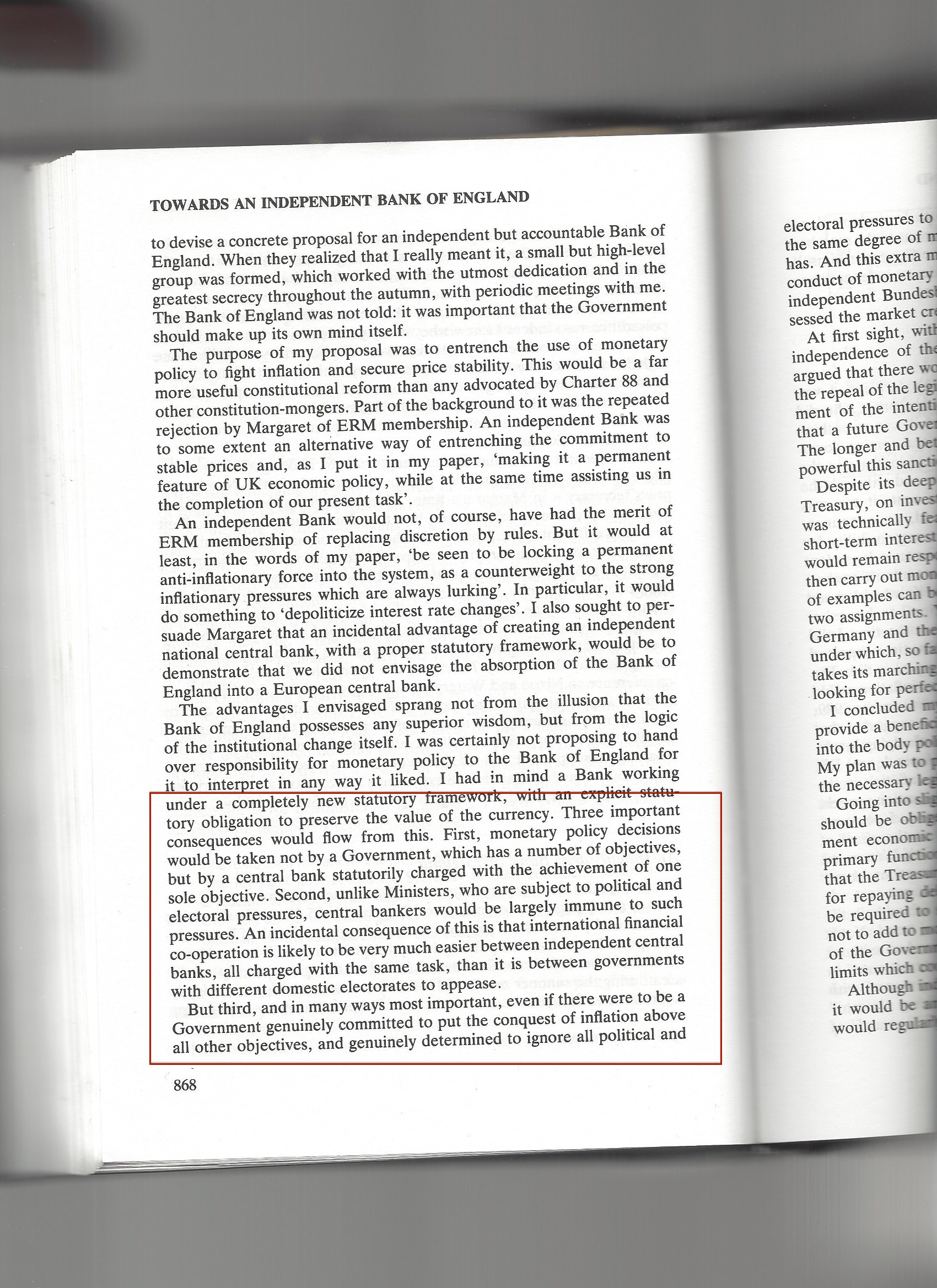

Tucker’s conclusion is that when politicians delegate policy decisions to independent, technocratic bodies, they need to do so in accordance with some key ‘principles of delegation’. To date, they have not done so, and hence the crisis of legitimacy, at least as far as it applies to economic institutions. There are five design principles: there should be a clear statement of the body’s purposes, objectives and powers, to stop mission creep; its operating procedures should be set out; so should its operating principles – how will it go about conducting its delegated policies; there should be sufficient transparency that the institution can be monitored and held to accunt by elected politicians; and there should be some rules for how it can respond to emergencies.

These seem on the face of it perfectly reasonable. But pause on the third – central banks and independent competition authorities should have the way they implement policy set out for them. Thus, Tucker argues, a competition authority’s remit might be set in broad terms as ensuring markets are competitive, or ensuring there is no abuse of dominance; but it should not be left to the competition authorities themselves to turn this into operational rules. He notes that there have been significant changes in competition policy in the US and EU over time, shifting from the older institutionalist tradition to a focus on consumer welfare. As the book notes, this reflected developments in economic theory, adding: “The significance of these momentous changes is not whether they were grounded in good economics but that each occurred without any amendments to the governing legislation.” Thus, “This gives us a glimpse of why the public might not be clear about the pupose and objectives of antitrust regimes.”

Like a number of commentators on competition policy recently, Tucker believes – wrongly – that the ‘Chicago School’ approach of using a consumer welfare criteria means competition authorities can only look at prices. On the contrary, although that has been the practice (because measuring prices is easier), they can take into account other aspects of economic welfare such as quality or range, or incentives to invest and innovate – this is set out in the CMA’s guidance documents, for instance. In the world of zero priced digital goods, that is exactly what they should do.

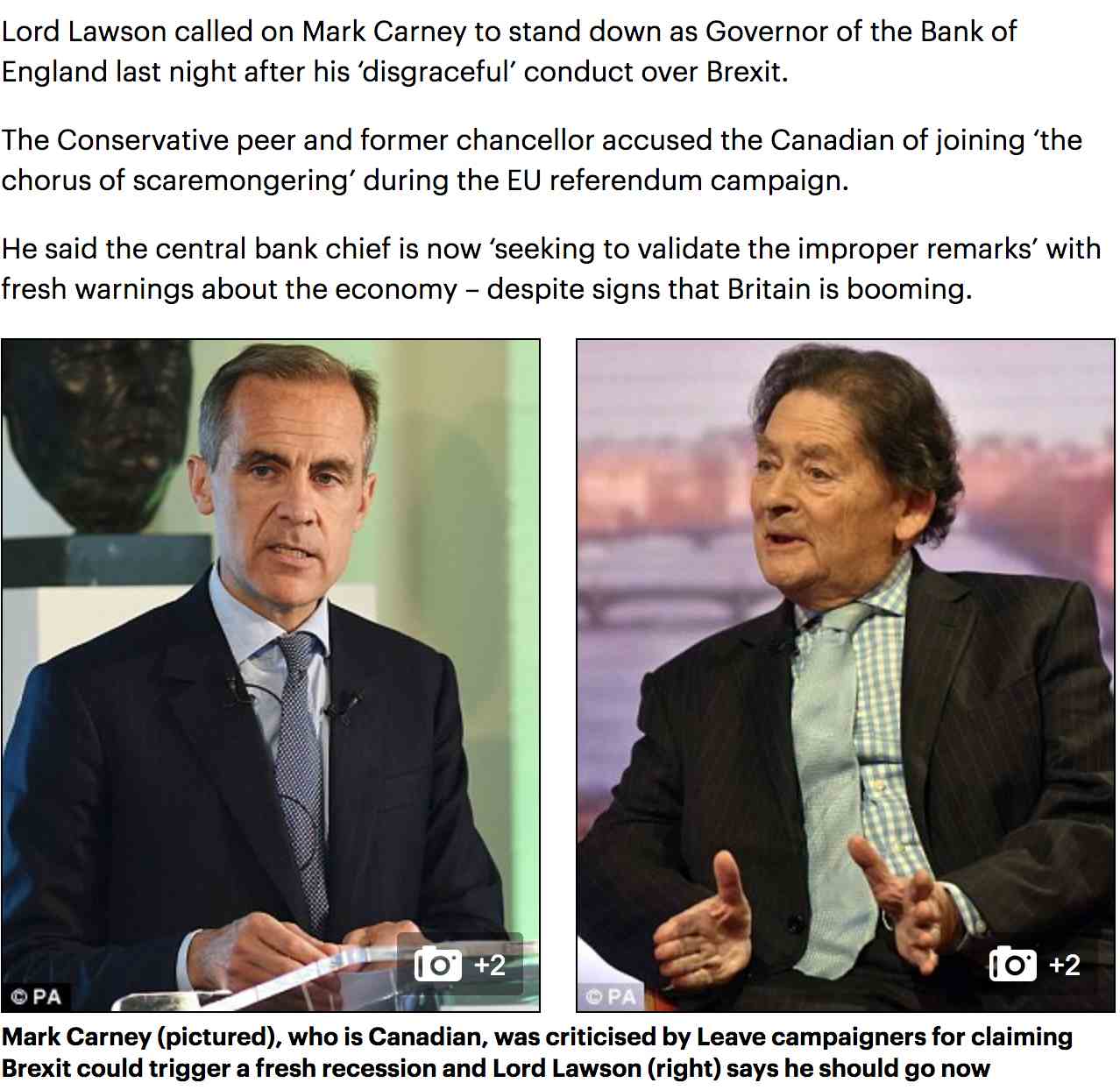

But that’s by the by. My hesitation about this principle is that the alternative – having operating rules set by elected politicians – would in reality defeat the purpose of giving economic regulators their independence. For what would stop legislators deciding that the economy is best served by preserving jobs at incumbent firms because they have the biggest economies of scale? This would be the pre-independence world of ministers deciding all mergers on public interest grounds. The time inconsistency problem common to so many regulatory contexts would return with a vengeance if legislatures can change the operating rules whenever they choose. Better to have these rules set by the technical experts, after wide public consultation. Sure, ideologies and tides in the realm of ideas would influence them, but less, it seems to me, than in the counterfactual world. Anyway, are elected politicians so respected now that they would reinject legitimacy back into economic governance? Opinion polling suggests they are among the groups the public trusts least.

Unelected Power engages an essential debate, however. There is a crisis of legitimacy in the western democracies. With QE, central banks have launched a radical change of policy with huge distributional consequences. The book has four sections: welfare, values, incentives and power are their headings. Although it touches on all the economic regulators, it is mainly about central banking, and on this is it authoritative. It will be an essential read for everybody involved in monetary policy, or researching it. It has a long bibliography; Tucker refers to legal and political science literatures as well as economics. One flaw is that it is heavy going in parts, surprsingly because he is a compelling speaker. Nevertheless, this is an important book.

[amazon_link asins=’0691176736′ template=’ProductAd’ store=’enlighteconom-21′ marketplace=’UK’ link_id=’12de507e-4bc5-11e8-994c-7f5fe15163db’]